Table of Content

- Technical/legal assessment fee for property

- Stamp duty, transfer duty and registration charges in Telangana

- Home loan administration fee

- Are Tax Benefits Available on Stamp Duty and Registration Charges?

- Valuation Fees / Inspection Fees

- Incidental charges on home loans

- Listed below are the TS registration charges for gift deeds.

As the process will be most likely the same for all states, but the percentages and charges will how to pay mod charges online in telangana from state to state. This Dharani portal is a one-stop shop for land transfer, registration, and updates. The Telangana High Court ordered the stamps and registration department not to gather information on land buyers and sellers such as Aadhaar numbers and castes.

Document – Other than authorising an agent or others to sell, transfer, or develop the immovable property, a general power of attorney is used for any other reason. Banks charge a non-refundable fee to process the home loan request of borrowers. Even if the loan request is rejected, the borrower cannot claim any refund of this amount. If any payments have been made through a cheque to the bank and this cheque bounces, the borrower will be made to pay a penalty.

Technical/legal assessment fee for property

In India, the state government is in charge of establishing regulations and norms + overseeing the collection process. The tax levied is usually set at a percentage of the total transaction value. Stamp Duty is a significant fee that must be paid when transferring property title in legal documents. The payment of stamp duty functions as proof of record in cases of property disputes under the Indian Stamps Act, 1899.

Earlier, the agreement/intimation relating to mortgage by the way of deposit of title deed was out of the public domain. Transfer Onliine is payable by the person acquiring the property, within six months of the date of acquisition. Without stamp duty and property registration, you will not possess the right to secure your property from any frauds. Nature of the Property– Stamp duty rates for residential properties are frequently lower than those for commercial buildings. Commercial properties are subject to a higher stamp duty fee than residential properties since they typically need a lot more amenities.

Stamp duty, transfer duty and registration charges in Telangana

So, when collecting documents from the bank after the settlement of your loan, do not take the MODT. Instead, insist on the bank to cancel the MODT and give you a “Deed of Receipt” executed by the mortgagee in favor of the mortgagor. However, if they do end up pushing it onto you, below are the guidelines on how to do the MODT Cancellation. E-filing of notice of intimation in case of mortgage by way of deposit of title deed came into effect on April 1, 2013. E-filing means the online or electronic filing of notices of intimation of mortgage of the property specified in Section 89B of the Registration Act, 1908. This means property subject to an equitable charge cannot be sold until that charge is cleared.

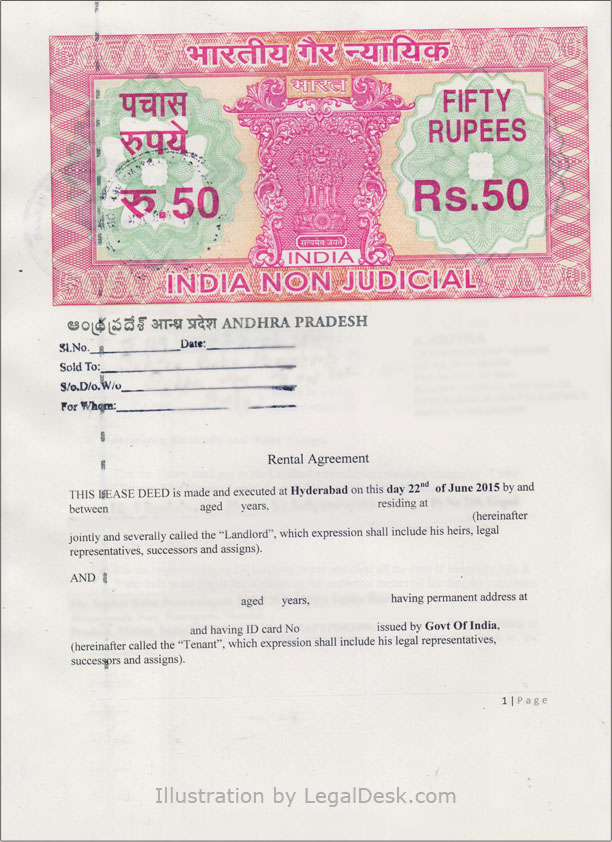

Non-judicial stamp papers that have not been used or have become spoiled can be returned for a refund. Non-judicial stamp papers, on the other hand, are only accessible up to Rs 100, and a government rule allows refunds through the challan system. Charges of stamps and registration in Telangana is payable on the higher the market value or the consideration amount in all of the instances listed below.

Home loan administration fee

Registration charges in Telangana – – 0.5% subject to min. Registration charges in Telangana – 0.5% subject to min. The documents to be presented at the sub-office of the Registrar to register Telangana stamp duty are listed below. But keep in mind that the registrar may ask you to get more documents as per the situation. At HDFC, ‘fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case.

Since this task involves legal and technical experts that the banks hire, the borrower is made to bear the cost of the legal and technical assessment. The charges are often higher for high-value properties, for which multiple rounds of technical and legal assessment may be required. When offering the home loan, the banks provide you a host of ‘services’, which brings it under the ambit of the Goods and Services Tax regime. Even though the loan amount remains outside the purview of this tax, GST is charged on the processing fee, administrative fee, technical and legal assessment fee, etc.

Are Tax Benefits Available on Stamp Duty and Registration Charges?

For the signing of all the documents and for getting the electronic clearing service activated, lenders may charge between Rs 500 and Rs 2,000 as the documentation charge. Banks inspect the property to ensure that it is not over lending. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Yes, a Controlling Revenue Authority (IGR & S) can order for refund on your appeal, if the penalty levied was charged on the higher side. You can ask for a refund for non-judicial stamp papers that were not used or spoilt. However, non-judicial stamp papers are available up to Rs 100 only and a government order has allowed refunds through the challan system.

It is essentially an undertaking given by you that you are depositing the title documents of the property with the bank at your own free will in return for a loan. For some banks, apart from the loan agreement, the undertaking needs to be registered and the government levies a stamp duty towards registration charges. Stamp duty charges vary from one state to the other, but on average, charges of 0.1 percent to 0.2 percent of the home loan amount apply.

As punishment, you may have to serve a jail term or pay a penalty of double the amount, or both. In such cases, the borrower will be asked to pay a fee for availing of the services all over again. Through the legal assessment the lender gauges whether the property is free from any sort of encumbrance and that there are no legal complications with respect to its ownership. Anyone who has a regular source of income can apply for home loans. Other eligibility factors like - age limits, income level, loan amount requirement etc. - may differ from one lender to another.

Have you thought of comparing the miscellaneous and other lesser-known charges while comparing various home loan offers available to you? Many home loan borrowers often end up skipping these details. Prospective loan seekers many a time just use interest rate as the basic yardstick to compare various home loan deals.

Home Loan Hidden Charges list can go on but i tried to include almost all the important Home Loan Hidden Charges. If i missed any then please feel free to add through comments section of this post. Also note that banks might not charge all the above mentioned Home Loan Hidden Charges.

The Dharani portal was supposed to include a portal for registering non-agricultural lands. The purchase or transaction cannot be acknowledged or received as evidence if stamp duty is not paid. In short – it is invalid, and such transactions will be seized by the law, along with a penalty. Note that paying a processing fee does not guarantee that your loan application will be approved. Since this charge is non-refundable, the borrower will not be able to claim any refund, if the lender rejects the home loan application. The payment can be made at the property registrar office.

Document Retrieval Charges are the charges levied at the time of loan closure/pre-closure. It is basically a cost of transferring original documents from central document repository to the borrower. Normally all original documents received by banks are divided into 2 parts i.e. Most Important documents like Sale Deeds, Sale Agreement etc and General Documents like Khata, NOC from association etc. Most important documents are kept in safe custody at central repository and is being normally managed by 3rd parties.

Men typically pay about 2% more in stamp duty than women do, with women receiving a subsidy on the fee. Listed below are the TS registration charges for gift deeds. Depending on the bank where you are applying for a loan, the home loan processing cost may vary between 0.50% and 1 % of the loan amount you applied for. As the name denotes, Late payment charge is levied when you delay payment of EMI, the bank will charge you for the penalty.

No comments:

Post a Comment