Table of Content

The Dharani portal was supposed to include a portal for registering non-agricultural lands. The purchase or transaction cannot be acknowledged or received as evidence if stamp duty is not paid. In short – it is invalid, and such transactions will be seized by the law, along with a penalty. Note that paying a processing fee does not guarantee that your loan application will be approved. Since this charge is non-refundable, the borrower will not be able to claim any refund, if the lender rejects the home loan application. The payment can be made at the property registrar office.

However, the new bank will first look at your repayment record before approving your home loan transfer request. In case you do not have any documentary proof of the same, you have to approach your home branch to get a copy. To provide this service, the bank charges a nominal fee. For future references and use, keep copies of the original document safe with you. Memorandum of Deposit or MOD in home loan is executed between banks and borrowers for obtaining home loan.

Documentation Charges

Amenities provided– The numerous amenities that a home or property contains also determine the amount of stamp duty that a person must pay. A property with fewer amenities would be subject to a lower stamp duty fee, whereas a property with more amenities would be subject to a higher fee. A higher stamp duty fee will apply to amenities including gyms, sports facilities, lifts, swimming pools, libraries, etc. The gender of the property owner– The majority of states charge men a higher stamp duty fee than women.

Have you thought of comparing the miscellaneous and other lesser-known charges while comparing various home loan offers available to you? Many home loan borrowers often end up skipping these details. Prospective loan seekers many a time just use interest rate as the basic yardstick to compare various home loan deals.

Home loan re-sanction charges

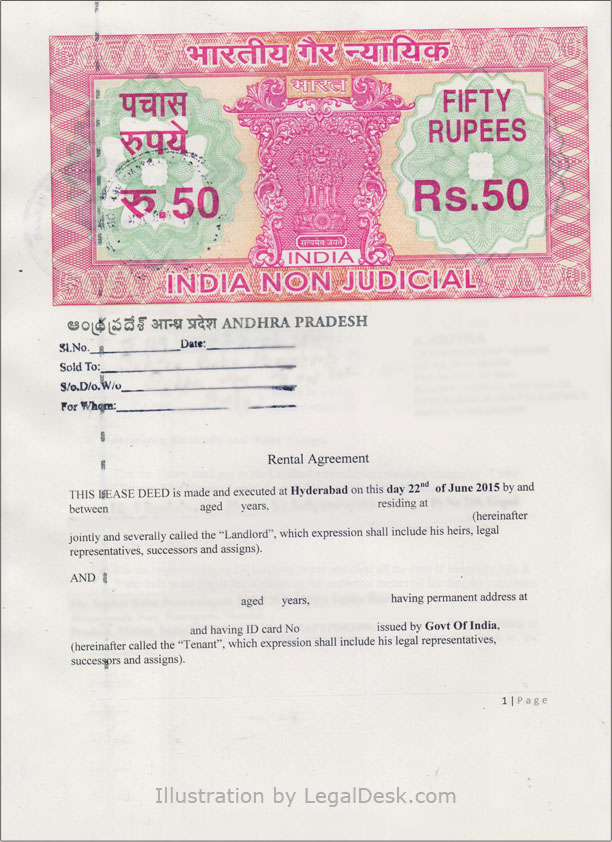

All banks charge a legal evaluation fee while processing home loan requests. The evaluation ensures there are no legal complexities involved in ownership of the property and that it is free from all encumbrances. While some banks charge only one levy known as the processing fee, others split it into two – as the processing fee and administration fee. The former is charged before sanctioning the loan and the latter is charged after sanctioning the loan. However, it would be naïve on the part of the borrower, to simply opt for the bank that offers the lowest rate of interest on home loans. Government levies a stamp duty for the registration charges.

Men typically pay about 2% more in stamp duty than women do, with women receiving a subsidy on the fee. Listed below are the TS registration charges for gift deeds. Depending on the bank where you are applying for a loan, the home loan processing cost may vary between 0.50% and 1 % of the loan amount you applied for. As the name denotes, Late payment charge is levied when you delay payment of EMI, the bank will charge you for the penalty.

Home Loan Rates by Top Banks

SBI, for example, charges 1% of the loan amount with a minimum of Rs 1,000 and a maximum of Rs 10,000, as the processing fee. Borrowers at HDFC, have to pay up to 0.50% of the loan amount or Rs 3,000, whichever is higher, as the processing fee. Sometimes, banks also waive the processing fees, to attract borrowers.

Head to NoBroker to find a home – BROKERAGE Free and HASSLE Free. If you need any legal help with Stamp Duty and Registration in Telangana please click below and reach out to us. Individual states determine the stamp duty rate, which is based on a percentage of the total value of a property. The registration charges in Telangana for the Rectification/ Ratification/Cancellation of any Deed are Rs. 1000. For any government official process, a set number of documents is required.

Banks may also ask the borrower to pay an incidental charge, to cover the risks in case of defaults. Suppose you initially opted for a 15-year repayment tenure, because you were able to pay the monthly EMI. Now, if you have to extend this tenure, because of a salary cut or any other monetary stress, the bank will impose a cost for changing the tenure.

Click on the confirmation link and confirm your signup New users who have not received email virtual money order app store mail click here to verify. The registration charges in Telangana for a release deed is – 0.5% subject to min. A delay in doing so would result in default, while also attracting monetary penalties. While some banks may charge a fixed amount, others may charge a fixed percentage on the amount of installment due, as the penalty. Now, if a borrower approaches his bank to get his existing loan linked to the new lending benchmark, the banks would process such a request, only after levying a cost for the same. While processing the home loan, important documents are usually kept at a central location.

The location of the sub-registrar office will be communicated through SMS once a slot is booked by online payment or by depositing challans on SBI. With the implementation of Dharani by the TRS government on September 8, 2020, all land registration operations in Telangana were placed on hold. The loan processing fee is also called a loan origination fee. This charge is levied by the bank for processing your loan application. It is a one-time charge based on the percentage of the loan amount you applied for. The most common among all Home Loan Hidden Charges is Conversion fees.

You would need to pay interest along with the EMI for the late payment. Home loans are a breather for many to fulfill their dream of owning a home. Getting 75% to 80% of the funds of the property cost from the bank makes you go further closer to your dream. You might be thinking that you only need to pay the fixed EMI to make your dream home come true.

Apart from the e-filing, as a temporary arrangement, citizens can file the notice physically. The notice should be filed within 30 days from the date of the mortgage. Here is one such charge you need to be aware of before taking up a home loan. Revenue (R&S) Department, Registration Act, 1908, Section 78 - Table of Fees, Revision, Simplification and Rationalization of fee structure - Orders Issued.

Stamp duty is an indirect tax levied by the state government on the purchase of the property. This could include an agreement to sale deed, power of attorney, conveyance deed, etc. All set to take up a home loan after due diligence and caparison of multiple quotes on interest rates and EMIs?

Such a scenario may arise, if the seller backs out from the deal at the last minute. This could also happen if the buyer starts to have doubts about the builder from whom he is buying the unit. Legal fees are charged when banks opt external lawyer to validate the legal aspects of your home loan. If you have been offered a lesser amount than what you applied for, the excess processing fees collected would be refunded in most cases. If you default on payment then bank will charge entire cost of recovery i.e. Charges may vary from Rs 250/installment, some % of recovery amount or Actual recovery expenses incurred by bank if recovery is under SARFAESI ACT.

Telangana’s government has set stamp duty at 4% of the property’s current market value. In addition, the new buyer will be required to pay a registration fee of 0.5% of the property’s value and a transfer duty of 1.5% of the property’s worth. Telangana’s state government sets the stamp duty, registration fees, and transfer duty rates. Telangana’s administration recently updated the state’s stamp duty levies, raising them by 1.5%.

No comments:

Post a Comment